Ann R. writes:

I have a 5 year fixed rate mortgage loan that will be maturing April 1, 2009. The current balance is $20,500 and the rate is 6.75%.

I am no longer living in the property and have been renting it for the past three years (same tenants) and I resigned from my job in November ’08 to attend grad school full time. Now that the loan is maturing I need to request an extension on the maturity date or refinance.

Since I don’t live in the property or no longer have a full-time job I am running into problems requesting either option from my mortgage lender.

Would a viable option be to put the balance on my credit cards spread over two cards (currently no credit card debt)? One card has a credit line of 13K with a fixed 3.25% rate until the amount is paid off and the other card has a 20K credit line with an option for a 2.99% rate until Oct. 09 then the rate goes to 9.99%. Please let me know if this is a good option or if I should do something else.

Thank you.

What do you recommend Ann should do? Has anyone else been in a similar situation? Leave your comments here and I’ll be sure to make sure Ann gets a chance to read not only my advice, but the advice of you (my readers) as well.

My response to Ann is below…

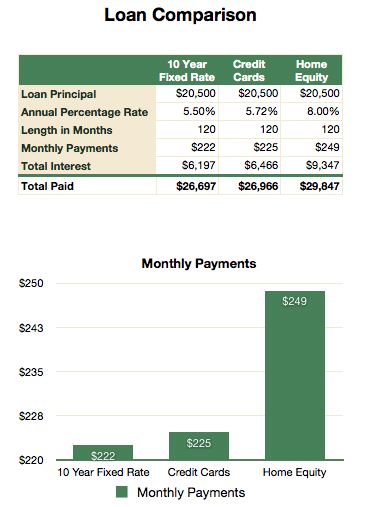

I’ve tossed around a few hypothetical numbers for you Ann, and while you may have some difficulties securing any of these options (due to your employment situation) you should be able to find lenders who are willing to work with you. So let me show you what I’ve come up with.

I know you’ve been having difficulty getting a lender to approve you for a new mortgage, and things are especially tight out there right now, but have you checked at any local credit unions or savings and loans? Being smaller institutions they should be more willing to work with you.

I know you’ve been having difficulty getting a lender to approve you for a new mortgage, and things are especially tight out there right now, but have you checked at any local credit unions or savings and loans? Being smaller institutions they should be more willing to work with you.

With that being said let me show you what I’ve done here. I plugged in three different scenarios, each based on a loan amount of $20,500 and a repayment time of 120 months (or 10 years).

Keep in mind that each of the interest rates that I plugged in for the three different scenarios are just estimates. As for the Credit Card scenario rate, I calculated this with $13,000 on that 3.25% card and the remainder ($7,500) on the 9.99% card (this creates a weighted average of 5.72%).

Now for the problem with these numbers. The biggest problem is that if you were to put $20,500 on credit cards your payment would be a LOT higher than what I calculated it to be. This is both good and bad. Assuming your rate stayed at this super low 5.72% you could pay off your loan in less than 10 years, but your payments would start at around $615 (based on a 3% minimum payment) and it would take almost three years to get your payments down to around $250 dollars.

My guess is that payments in the $600 range might be a little high for a part-time grad student. Your best bet would be to get your mortgage refinanced, but I also thought you might check around at your local credit unions to see if they offer a home-equity product that’s structured more like a mortgage. It should be easier to qualify for (even with your part-time income) as long as your credit is good. On top of that any interest paid should be tax-deductible. For an example of this type of home equity product check out this link to the Master Mortgage at Desert Schools FCU.

Good luck with getting this refinanced Ann! To all of my readers, don’t forget to leave your comments at the end of this post!

3 responses to “What Would You Tell The Grad Student with A Loan Maturing Soon?”

I don’t recommend putting the remaining balance on your credit card for several reasons.

1.) As Debit vs Credit aptly points out, the weighted average of your interest rates would knock your payments into the $600 range, which may be outside of what you can currently afford to pay.

2.) Transferring secured debt to an unsecured vehicle is going to wreak havoc with your credit score and could cause the interest rates on those two cards to go up, which would increase your payments further.

3.) No tax deductions available on the interest of that unsecured debt.

Given your situation, I recommend visiting a credit union or savings and loan institution. Be sure to have the lease agreement on hand. It may even be beneficial to have your tax returns (if you’re reporting the property as rental and showing it on the tax return). You may not necessarily have to show earned income from the deal, but if you can prove you’re not making the payments, that may give you a little leverage in dealing with the financial institution. It all depends on who you go through, though. The credit union I work for would consider that, so it’s not unheard of.

A different option would be a home equity loan. Sometimes these can be easier to get than a mortgage, and if you so chose, you may even be able to get cash back out of the deal. The only downside to this is that, a home equity in first lien position does not come with escrow. You would be solely responsible for your taxes and insurance. But, the interest in most cases is tax deductible, so that’s an advantage for you.

Something else to consider is to sell the property outright. It clears up the problem of refinancing and would even give you a little extra money while you’re in grad school. But, I don’t know the circumstances surrounding the house, so you may not want to. It is available to you, though.

Another option to consider – and one I only mention as a very last resort – is a reverse mortgage. Given your situation, you may be able to do this, as well. Now, the specific details of how this works will vary per institution, so you’ll want to check with yours to be certain. But the premise of this deal is that basically, you’re mortgaging your home to the bank. They make monthly payments to you and at the end of the term, they own the property. Not very attractive, but an option nonetheless.

Hope this helps!

Kristy @ Master Your Cards last blog post..When To Use Your Emergency Fund

Fantastic points Kristy! I’m glad to hear that someone else is recommending checking with a credit union. I’m quite sure that even with being only part time that Ann would have a much easier time getting approved for another secured loan at a credit union – especially if she can prove that her rental income is steady.

No variable interest rates – If you have accumulated Student loans and little things that have in the school as phone bills tend to be variable interest rates. This means that you are not necessarily the same amount… Not even a fraction of a percentage point can equate to thousands of dollars over the life of a loan. Announce base interest rates for Student loan consolidation are similar from one company to another…