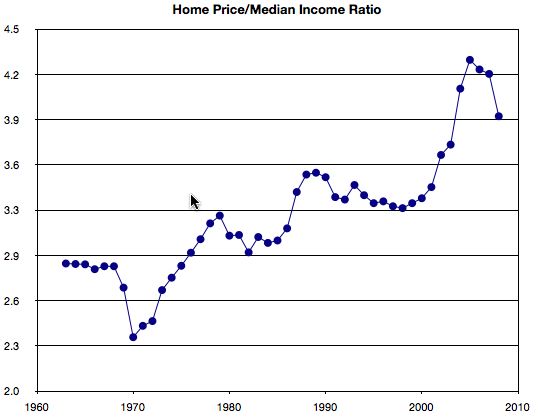

I’ve been looking at real estate for about a month now, wondering if the time is right to buy a home, or if I should continue to wait. Unfortunately I may never know the answer to that question, as it’s almost always impossible to time the market. I can, however, use statistics and reason to at least come to an educated guess. That’s what I’ve tried to do with the following graph:

Let me explain what I’ve done. I looked up the U.S. Census figures for the median new home price in the U.S. from the years 1963 through 2006. I also looked up U.S. Census figures for the median household income in the U.S. from the same time period. Then I divided the median price by the median income to come to a number. That number is what you see on the above graph.

As you can see, up until the mid-70’s the median price of a home never exceeded more than three times the median household income. At the peak of the Real Estate market that number was up to almost 4.5x the average household income. What does that tell me? It tells me what everyone already knows – houses were just too damn expensive.

Obviously we’ve seen a major reduction in home prices, but thanks to the recession we’re also starting to see falling income levels. Unfortunately I didn’t have figures from the U.S. Census for the years 2007 and 2008, so I guesstimated that the average houshold income is holding relatively steady from the year 2006 (of course this may be completely incorrect). I was able to get the median new home prices for the years 2007 and 2008, so I did not have to guess those figures.

As you can see on the far right side of the graph the market is beginning to collapse. But it’s still far above what it has historically been. Based on that I’m afraid now may still not be the time to buy… at least if you want to buy at the bottom of the market.

Any thoughts?

8 responses to “Why Now May Not Be The Time To Buy A House”

I like your reasoning Joe. I recently saw another piece of evidence that also suggests that home prices still have farther to fall. It was some guy on 60 Minutes explaining how the second round of the housing collapse hasn’t yet hit yet. It’s another absolutely enormous batch of option-type mortgages just like the subprime ARM’s that have been resetting with higher rates over the past year or so. This new batch really doesn’t start resetting until this year and into 2010, and the predicted foreclosure rates when they do is pretty outstanding.

If his analysis is correct, the home market will be flooded by many, many more foreclosures before the unraveling is complete. I wish I remembered the name of the clip so I could give you a link to it. It was really good.

On the flip side though, interest rates have nowhere to go but up. My guesstimation is that the extremely low levels we are seeing now will soon (6 months to 1 year) be replaced by quickly rising rates due to inflationary pressure. I could easily be wrong, but that possibility also needs to be accounted for.

Blakes last blog post..Book Review: Personal Development for Smart People.

Interesting thoughts Blake. I didn’t see that interview on 60 minutes, but that’s very interesting. I agree with you very much on the interest rates rising soon as well, which could very well prolong this housing crisis we’re facing. It’s rough out there and it’s hard to guess when is a good time to buy (assuming you’re wanting to buy).

Incomes should have a greater impact on home prices now since lenders have returned to more conventional underwriting guidelines with FNMA debt ratios at 28/36% of gross income.

I like your idea Incomes should have a greater impact on home prices now since lenders have returned to more conventional underwriting guidelines with FNMA debt ratios at 28/36% of gross income.the home market will be flooded by many, many more foreclosures before the unraveling is complete.

Found it- http://www.cbsnews.com/stories/2008/12/12/60minutes/main4666112.shtml

Blakes last blog post..Book Review: Personal Development for Smart People.

Very interesting. I sure hope that some of those figures quoted in that article are not even close. To be honest with you I’m likely going to be buying a house this year (been planning to do so for a couple of years now) and I’d sure hate to buy something and then have all of my neighbors foreclosed on, leaving the neighborhood in ruins.

Well, as a financial planner for 30 years I agree with the issue of a “residence” NOT being “an investment” unless it is a rental property. Problem is that in the last 6-8 years uninformed people, lured by an exploding ability to communicate, publish and disseminate hyped information about how “residential real estate” can be a “best investment” have speculated on residential real estate and the tax code favors this type of short term “home” holding period and sale tax-free. Low interest rates and hype have skewed the data that all have reviewed…now for the future.

Who knows, but this has happened before. It will take time and the “invisible hand” of economics lore will provide the answer that will only be known after the event has occured. Location, Location, Location as well as quality will now be the rule…the residential real estate marketplace moved away from these time tsted rules. BL

Great blog. I really didn’t understand much about APR and since my debit card was frauded last year, I’ve tried to make an effort to understand everything I can about credit and debit cards