If you ask just about anyone in the world if they would like to be rich they will more than likely respond in favor of wealth. No one actually wants to be poor. In fact some of us want wealth so badly that we’ll do almost anything to get it. Wars, murders, lies, deceptions, fraud – these are all (almost always) caused by the desire to achieve wealth. There’s no way getting around that. Not all of us are so easily compromising on our standards, however, as evidenced not only by the virtuous wealthy, but also by those who passed up on wealth because they were unwilling to compromise who they are and what they believe in.

I’m like everyone else really. I want to be wealthy, but I wish for this wealth for specific reasons. I won’t compromise on my methods of obtaining wealth either because that would compromise my reasons for wanting to obtain wealth. There are 5 reasons I want to be a millionaire.

1. I want to be free of debt and financially independent.

This reason for my desire for wealth predicates each and every other reason that I have. It’s important here to not confuse being “in the money” with truly being wealthy. So many people in the world appear to be wealthy but in reality are up to their knees in debt. I don’t want this. I want to be financially independent and by this I mean little to no debt and loads of cash or securities that are easily convertible to cash.

2. I want to have the power to choose to do anything I want to do.

If I wake up one morning and have a great new idea for a product or a business I want to be able to act on it. This will only be possible if I have the wealth necessary to do so. This also applies to holidays and even education. Some day I’d like to get a degree in electrical engineering. I want to know how circuits and all of those complicated electronic (and computer) parts function. Also I’d like to eventually see the world. Unfortunately travel is expensive and unless I can achieve true wealth I might never accomplish this goal.

3. I want to have a lasting impact on the world.

My wife and I are very charitable-minded. We’ve donated to several charities since we married two years ago and this is even as we try to support my education, save a downpayment for a house and build an emergency fund. So many people in the world have less than we do and even though we don’t have everything we want it feels wrong to not try to support those in need. One day I’d like to start my own scholarship fund and possibly even a charitable organization. In the meantime there are hundreds of fantastic charities which need monetary donations.

4. I want to be in a position to be able to support my parents.

If my parents ever need help in their retirement (with medical or monetary things) I’d like to be in a position where I can support them. They gave me everything that I ever needed for 18+ years of my life and I want to be able to return the favor. Likewise I’d love it if I could be in a position to help my family members out in times of crisis.

5. I want to be able to support my hobbies.

Let’s face it, we all have hobbies that we wish we could support. For me blogging is a hobby. I wish I could do it more, but I have to work and go to school. Of course there are also the less-productive hobbies. I like to play with tech toys – my MacBook Pro, HD TV’s, etc. These electronics are often quite expensive. I also like to play video games occasionally and they cost money as well.

What are your reasons for wanting wealth? Or are you already wealthy? If so, what do you do with your money, if anything?

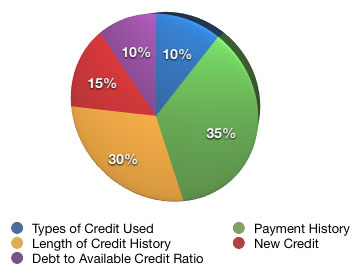

If for whatever reason you are not aware of the FICO credit scoring system, then let me quickly explain. Credit scoring systems were created by lenders and other financial institutions as a way to grade risk. Basically they created mathematical logarithms (pretty neat stuff really) which take into account all of the data available on if you pay your loans on time, the ratio of your current debt to the debt available for your use, how often you apply for loans and credit and the length of time that you have had your loans and lines of credit. The FICO credit scoring system is used almost industry wide between lenders and other financial institutions. The FICO credit score can range between 300 to 850 points, with the median (meaning half over, and half under) FICO score of Americans being somewhere around 720 points. The FICO score is calculated and impacted by five different variables, which can be seen on the pie chart to the left.

If for whatever reason you are not aware of the FICO credit scoring system, then let me quickly explain. Credit scoring systems were created by lenders and other financial institutions as a way to grade risk. Basically they created mathematical logarithms (pretty neat stuff really) which take into account all of the data available on if you pay your loans on time, the ratio of your current debt to the debt available for your use, how often you apply for loans and credit and the length of time that you have had your loans and lines of credit. The FICO credit scoring system is used almost industry wide between lenders and other financial institutions. The FICO credit score can range between 300 to 850 points, with the median (meaning half over, and half under) FICO score of Americans being somewhere around 720 points. The FICO score is calculated and impacted by five different variables, which can be seen on the pie chart to the left.