I spoke earlier about how it’s important to set personal finance goals. Today I’d like to expound on this idea a little. It’s absolutely important to sit down and make finance related goals, and what better time to do this than at the start of a new year? Of course if you’re going to sit down and make goals for yourself you’ll have to think about your finances and if you have a family it’s probably a good idea to talk with them about your financial situation as well (especially your significant other).

Have you begun to think about your financial situation and where you’d like to be in a year? If you haven’t yet it’s not too late. Go ahead and sit down, do a little brainstorming and see what you can come up with. Here are a few ideas to get you started.

Review Your Insurance Coverages and Needs

Do you have a family? Are you the primary (or the sole) breadwinner? Do you own a home?

If you’ve answered yes to any of these questions (or more than one) there is a good chance that you need life insurance. If you don’t already have life insurance then now would be the time to look into it. God forbid that something bad were to happen to you or your significant other, but if one of you were to tragically pass then what sort of a financial situation would that leave your family or significant other in?

Another thing to consider is disability insurance. If you were to become disabled would you lose your income? Most employers offer disability insurance as a benefit to their employees. Check to see if it’s a benefit that you’re receiving, and if you’re not then consider signing up for it. My friend Trent at The Simple Dollar has made it a goal of his to review his insurance needs so he can be prepared in the event of a disaster.

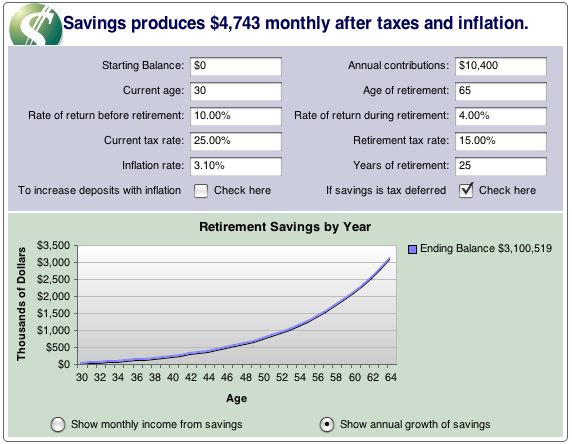

Review Your Retirement Accounts & Plans

Are you participating in your 401k retirement account, or if it’s not an offered benefit are you investing in an IRA or Roth IRA? It’s important to start planning for retirement at an early age because the sooner you begin saving for retirement the sooner you’ll be able to retire, or the more money you’ll have when you retire.

Make sure to review the retirement plans that you have in place and if you’re not already investing in a 401k or similar retirement plan it’d be a great idea to set a goal to start saving for retirement.

Pay Down Your Debts

Do you owe thousands of dollars in credit card or other unsecured debt? This would be a great time to review what you owe and what you can do to pay down your debt as much as possible. My friend Doctor S at Finance Your Life has set himself a goal to pay down a large portion of his student loan debt throughout the next year.

Don’t Do Nothing

I hope these tips have helped to give you an idea of the kind of planning and resolution setting that you can do in order to improve your financial situation. The important thing to remember is this: don’t do nothing. I know it’s worded weirdly, grammatically speaking, but it’s true. Plan for the future and you’ll be in a much better position than you’re in today. Good luck on those New Year’s Resolutions!

While most people yearn for wealth not all will achieve any significant levels of wealth in their lifetime.

While most people yearn for wealth not all will achieve any significant levels of wealth in their lifetime.

It’s my favorite time of the year once again. I’m out of school until next semester and right now all I have to worry about is going to work and making money. I still have a job and I don’t have to worry about losing it either so to be completely honest with you, my life is going pretty well.

It’s my favorite time of the year once again. I’m out of school until next semester and right now all I have to worry about is going to work and making money. I still have a job and I don’t have to worry about losing it either so to be completely honest with you, my life is going pretty well.