If you’ve ever used Quicken, Microsoft Money or another personal finance software program you know how easy they can make it to track your spending habits and other finance related things, such as your investment performance. Mint is personal finance software that is somewhat along the lines of Quicken and MS Money, but with a more streamlined focus.

If you’ve ever used Quicken, Microsoft Money or another personal finance software program you know how easy they can make it to track your spending habits and other finance related things, such as your investment performance. Mint is personal finance software that is somewhat along the lines of Quicken and MS Money, but with a more streamlined focus.

Mint is an online money management program, which basically means that you can use it anywhere that you have access to the internet and a modern web browser such as Firefox, Safari or IE 6+ (on a somewhat related note if you’re still using IE6 please upgrade to IE7, or even better, Firefox). Mint is relatively straightforward and pretty simple to use, but the best part about it is that it is completely free.

Mint makes money by offering you products that it feels will be able to benefit you financially. While this system is not perfect, it works pretty well. You don’t have to deal with annoying ads and you get decent suggestions for financial products. I can live with that.

Mint recently came out of beta, which means that the service is supposed to be quite stable. While I have not experienced any major issues with Mint I do have a complaint. They support most (if not all) of the large financial institutions (your BofA’s, Chase’s, and Vanguard’s of the world) but if they don’t currently support your financial institution you’ll likely end up waiting just about forever for support to be added. I’ve been using Mint for about 7 months now and they have yet to add support for my credit union, let alone ask me for assistance (I’ve volunteered to test the support process) in doing so.

Using Mint.com

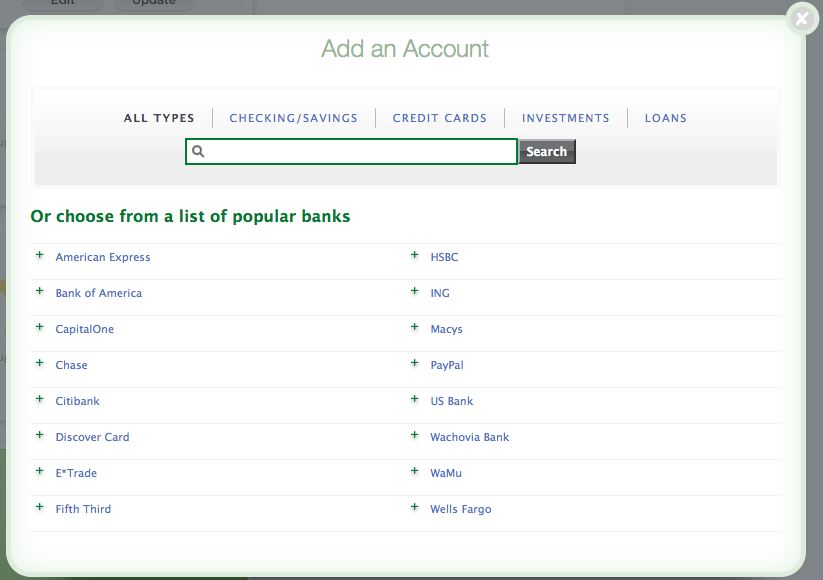

As I previously mentioned Mint is pretty straightforward and quite easy to use. After you initially sign up Mint will walk you through adding accounts and you’ll also have the option to set up a budget (if you don’t do this then Mint will create one based on your spending history). You can set up accounts based on different categories, such as Investments or Spending accounts (checking & savings) and Mint even offers support for loan accounts.

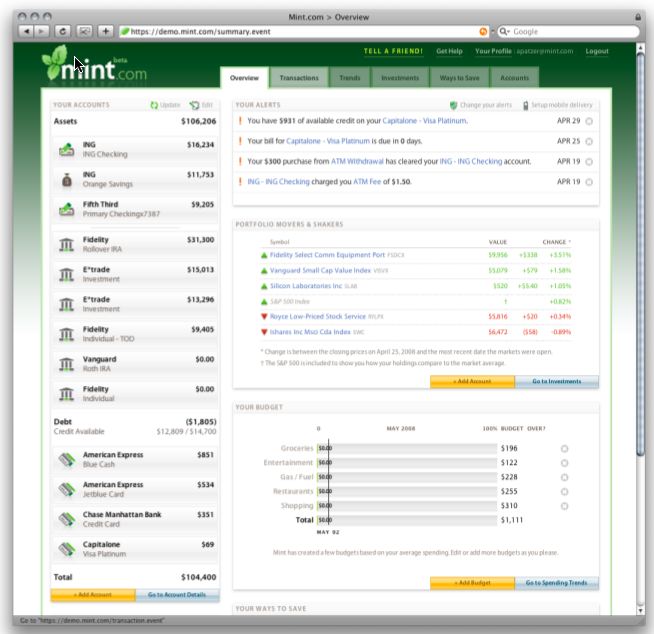

Once you have your accounts set up on Mint you’ll become quite familiar with the Overview screen, which shows a quick overview (did they name it well or what?) of your account balances any large transactions you’ve made recently, bills that may be due soon, investment performance in the past 7 days and even your budget for the month. The screen looks something like this…

From the Overview screen you can navigate to more detailed information such as a listing of your transactions, spending trends (complete with pretty graphs) and investment information.

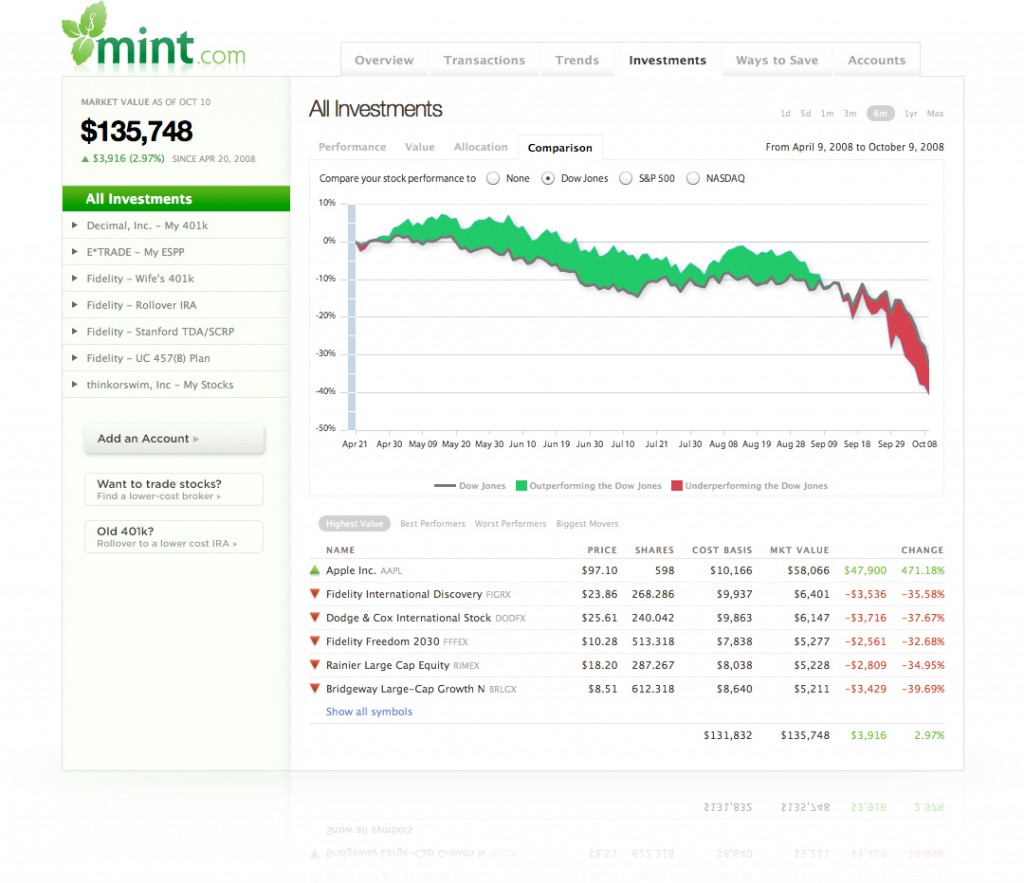

The investing section of Mint is definitely one of the most helpful features that Mint offers.

If you can’t see the image very well you can click on it to view it in its original size. Anyway, back on topic. What I really like about Mint is that you can compare your portfolio performance to that of well known stock indexes such as the S&P 500 and the NASDAQ. Mint will let you know the change in your portfolio, as well as compare it to the stock indexes. It graphs the performance and basically if the graph is green your portfolio is performing better than the selected index, and if it’s red then your portfolio is underperforming the selected index. Pretty simple, but a great way of showing you how your investments are doing.

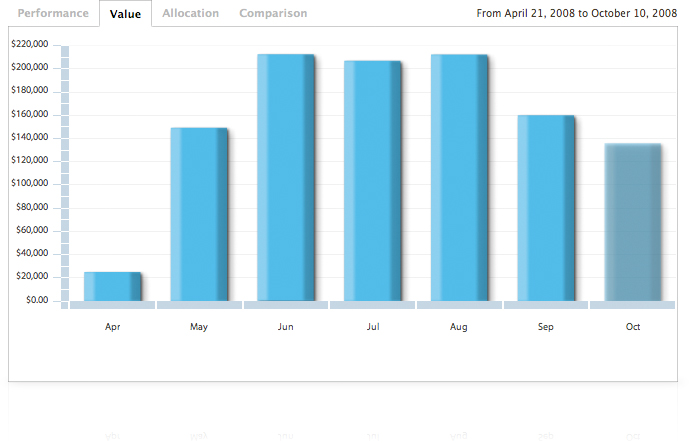

Another thing that I really like about Mint is it shows you a nice clean line graph of the value of your investments over the past 7 months (assuming you have 7 months of history, of course). Again it’s simple, but it’s presented very well and just makes it that much easier for someone who might not really have any other way of tracking the performance (or value) of their investments.

The Verdict on Mint.com

While Mint isn’t perfect (especially when it comes to supporting some of the smaller financial institutions) it’s a wonderful money management program and the fact that it is completely free is hard to believe considering all of the features that it offers. I’m sure that over time Mint will continue to make upgrades to its software which will mean more features for us end users. Overall I really enjoy using Mint and I have yet to find any online personal finance software that I like better.

On that note: Mint, if you’re reading this – what can we do about getting support for my credit union?

4 responses to “Personal Finance Software Walkthrough: Mint.com”

And also, when can we add our margin brokerage accounts? I cannot use Mint to track them because Mint does not understand the value of these accounts and reports totals as something non-helpful like amount available to trade, but definitely not the actual value of the account.

444s last blog post..What’s the cost? A handy calculator

Good to know. I don’t use a margin account myself, so I hadn’t realized that Mint was unable to track it. Good point.

I have used mint for awhile but recently switched to heaps!. They are similar but heaps offers a few more features

http://www.heaps.co.nz

I can recommend mint.com for a personal finance planning software. It’s an online service, free and pretty good. It does everything I want (except access non-US accounts). It’s made by the people who make Quicken, too.